When Should I Create A New Donation Form?

What's The Best DAF Widget?

How To Use Earth Day In Your Marketing

Gift Dedication -- What, When, Why, How

Maximizing Employer Match Opportunities

GivingTuesday Checklist - Ready, Set, Go!

How To Tell Your Story

What Is Your Call To Action?

GivingTuesday Campaign Ideas

GivingTuesday Email Templates and Subject Line Guide

GivingTuesday Resource Guide

Who is your Social Media Audience?

How to Create an Effecive Social Media Post

How to Use Hashtags

Improve Donor Engagement

How To Segment Your Audience

How To Segment Your Audience Using GiveDirect Reports

How Often Should I Ask My Donors For A Donation?

Don't Miss Out On Employer Matching Gifts

Steps To Register With CSR Platforms

QR Codes - Free, Easy, Awesome!

4 Reasons To Love Canva

6 Ways To Thank Your Supporters

Minimizing Card Testing Fraud

CAPTCHA: What Is It and Why Is It Necessary?

Principal Controlling Officer and Know Your Customer

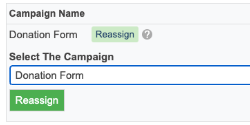

Reassign A Transaction From One Fundraising Form To Another

Credit Card Updater For Recurring Payments

Fundraising Progress Bar

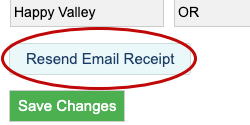

Help, My Donor Didn't Get An Email Receipt

Where Is The Gmail Spam Folder?

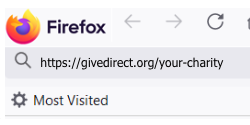

Custom URL

One Click Reports

Micro Campaigns and Fixed Minimum Campaigns

Donor's Year-End Statement

Background Image Best Practices